The Insurance sector in the UK and worldwide is crying out for affordable technology to effectively manage risk, reduce loss ratios and permit a more flexible customer experience, all tailored to way the customer uses their vehicle. As the new Global Director of Insurance and CEO of our UK operation, I would like to share some of my thoughts on the future of risk management for the sector.

The Insurance sector in the UK and worldwide is crying out for affordable technology to effectively manage risk, reduce loss ratios and permit a more flexible customer experience, all tailored to way the customer uses their vehicle. As the new Global Director of Insurance and CEO of our UK operation, I would like to share some of my thoughts on the future of risk management for the sector.

The time for using AI driven data insights from non-static data is now. The way this is changing the underwriting world can no longer be ignored. We already see AI and actual movement data adopted across several other sectors and industries.

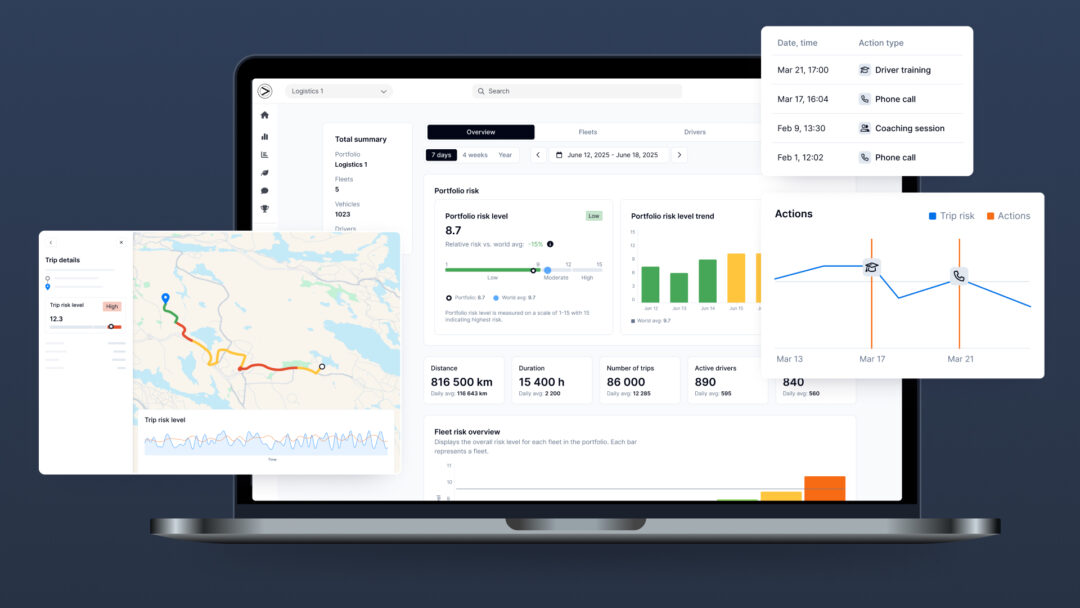

Greater Than’s cutting edge AI capabilities represents a giant leap forward in our ability to understand how the vehicle, the driver, the road, and the environment interact, to provide unique patterns or Driver DNA. This DNA driven from billions of trips using 1 second GPS reporting and correlated crash data, means insurers can accurately predict an ultimate loss ratio from as little as one mile of driving.

All this can be done from a smartphone app tethered to the vehicles Bluetooth connection or via already installed telematic system. This AI driven analytics can also be used to review an insurers existing GPS data, potentially bringing a myriad of different historical data sets together in one scoring system.

This easily applied AI technology will deliver such insight and accuracy in early assessment of loss ratios, that most current platforms that don’t use it may overtime become very exposed even obsolete or at least inadequate. It’s very similar to the evolution we saw with the introduction of credit score, only even more predictive.

With many white labelled solutions to choose from, Greater Than offers excellent flexibility for insurers to catch up and get ahead into future of mobility, including the gig economy and electric and autonomous vehicles.

Here are a few of the features from Greater Than that I see will shortly become standard tools to mitigate and manage risk.

The Insurance sector in the UK and worldwide is crying out for affordable technology to effectively manage risk, reduce loss ratios and permit a more flexible customer experience, all tailored to way the customer uses their vehicle. As the new Global Director of Insurance and CEO of our UK operation, I would like to share some of my thoughts on the future of risk management for the sector.

The Insurance sector in the UK and worldwide is crying out for affordable technology to effectively manage risk, reduce loss ratios and permit a more flexible customer experience, all tailored to way the customer uses their vehicle. As the new Global Director of Insurance and CEO of our UK operation, I would like to share some of my thoughts on the future of risk management for the sector.