Risk intelligence

Platform

Features

Technology

New product

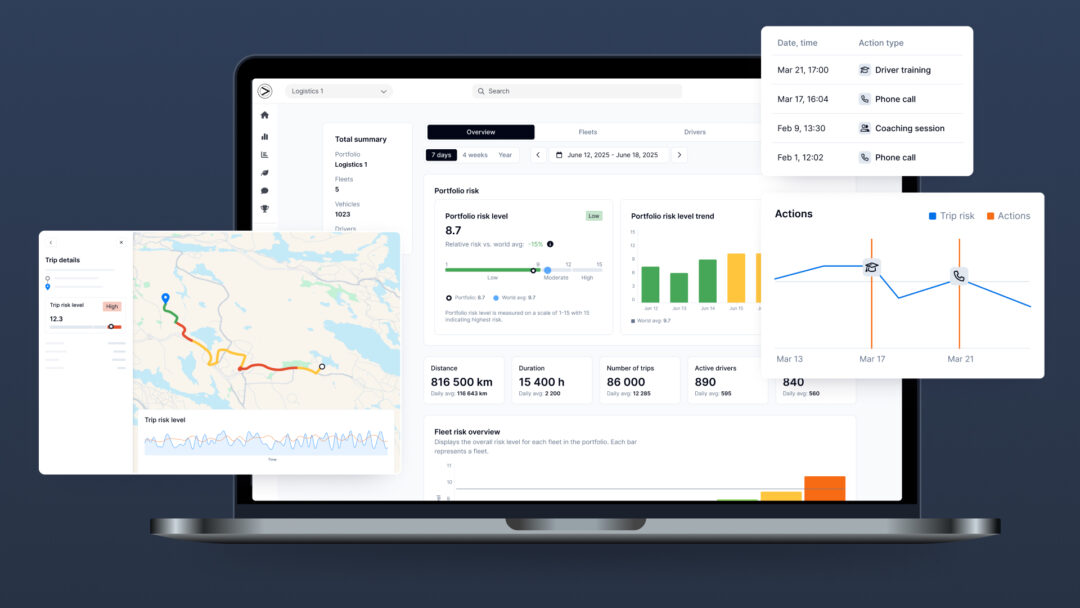

Crash Probability Hub

It will transform the way organizations visualize, understand, and reduce driver risk.

Our AI

Global benchmark for road safety

How our AI works

Comparing driving patterns to toy blocks

Read about the pattern profiling that makes our AI globally unique.

Our products are used for

By category

Press release

Greater Than and Honda announce R&D partnership to quantify crash risk

Greater Than

Investor relations

This is Greater Than

See the future with Greater Than

Learn more about what we do in this video.